This COVID-19 outbreak has turbocharged the rise of digital healthcare platforms and solutions to aid healthcare workers, says Mark Greeven.

SINGAPORE: It’s hardly surprising that online gaming, video streaming and fresh food e-commerce are in high demand during what has become over a month of (self) quarantine for many Chinese during the outbreak of the COVID-19 virus.

More interestingly, adapting quickly to this new reality, Chinese schools have massively adopted online education and Chinese companies online work tools such as Ding Talk.

But COVID-19 may also be providing China with a sort of Med Tech leap – and Big Pharma and Medical Technology companies ought to be watching.

China’s Big Tech is taking up the challenge – and responsibility. Broadly speaking we see two promising developments and deployments of Med Tech: Tracking and consultation leveraging big data and doctor’s assistance leveraging artificial intelligence-driven solutions.

RISE OF DIGITAL HEALTHCARE PLATFORMS

First, in the past weeks, we have seen digital healthcare platforms such as Tencent’s WeDoctor, PingAn’s Good Doctor as well as independent platforms such as Hangzhou-based, Dingxiangyuan (DXY), opening up their platforms.

They offer consultation and advice, tracking the virus development in real time and continuously providing warning and reminders.

DXY, for example, aggregates NHC (National Health Committee) and local CCDC (Chinese Center for Disease Control) situation reports in near real-time. It provides more current regional case estimates than the national level reporting organisations are capable of and is thus used for all the mainland China coronavirus cases.

Over last week, we saw Alipay, Tencent, and other tech firms, deploying apps that produce coloured QR codes based on user responses to questions about travel over the past two weeks. These apps enable the government to track at-risk individuals and keep a close eye on everyone else as businesses resume operations.

The data coming out of the public and private sectors is also being leveraged outside of China as the virus spreads beyond China’s borders.

For instance, Canada’s Bluedot which employs AI to track and anticipate infectious diseases, uses DXY’s data to support its offline clients including governments, hospitals and businesses. Bluedot correctly predicted the virus’ likely path from Wuhan to Tokyo using its AI and available data feeds.

Similarly, John Hopkins’ Whiting School of Engineering built a dashboard of case data from various sources including DXY, CCDC, NHC and the World Health Organization to track the spread of the virus.

GREATER SUPPORT FOR DOCTORS

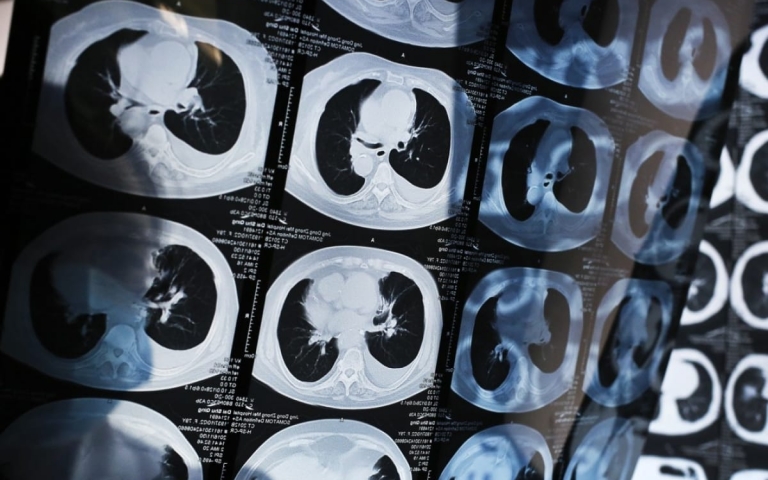

Second, huge numbers solutions for supporting directly or indirectly Chinese doctors have been launched. For instance, in end-January, Yitu Technology, in partnership with the Shanghai Public Health Clinical Center, launched the Intelligent Evaluation System of Chest CT for COVID-19 an AI-equipped diagnostic assistant.

Another company, United Imaging, a medical image scan analysis provider, has developed a similar system.

In fact, these and other AI-driven solutions have quickly emerged in response to a request by the Ministry of Industry and Information Technology of the Chinese government.

By last week, over 300 AI systems developed by companies have been suggested to support doctors and nurses – from cleaning robots, chatbots and other applications. For instance, Megvii, an image recognition giant with global success, has deployed a temperature measurement system in Beijing.

And, often ignored, social e-commerce challenger Xiaohongshu – also known as Little Red Book – has offered free psychological consultation for patients and medical staff. Baidu launched a semi-sophisticated self-diagnosis tool that combines the Chinese government diagnosis and treatment plans with millions of online medical consultations to assess whether a user is likely to have contracted the virus.

There is some patchiness in how effective these solutions are. For instance, Sogou launched a search features that allows you to understand the epidemic situation of your surrounding by providing statistics on confirmed patients in your community.

While this digital experiment may fail to add real value, regardless, the amount and quality of solutions to support the healthcare system is nonetheless impressive.

WHY THIS SURGE IN MED TECH MAY BE MORE PERMANENT

The question then arises whether this is a temporary boost in Chinese Med Tech or a more permanent one. There are at least three reasons why China might be creating the future of Med Tech.

First, China is a society that has embraced digital technology with wide arms.

Although just 60 per cent of Chinese people have access to the Internet, the 800 million that are online use among the world’s most advanced digital solutions – from digital payment, healthcare, education, retail to the rapid adoption of artificial intelligence in managing cities and smart factories.

So, the current embrace of digital solutions and innovative Med Tech is by no means surprising.

Second, a recent study by Philips finds that China leads the world in digital health adoption. In particular, health care professionals, facing massive numbers of patients in overpopulated hospitals, are more likely to recommend patients use technologies to self-track health indicators than their peers in the West.

For instance, in China over 50 per cent of patients had shared data from connected devices with healthcare professionals, as compared to less than 25 per cent to the UK.

With the current health threat spreading across urban and rural boundaries – and a seriously challenged healthcare system – China, and the world, should be lucky to have developed the habit of telehealth and self-tracking of personal health.

Third, although the current crisis may prove to be a boost for Chinese Med Tech, by no means it is the start of this trend. China is already the world’s third largest Med Tech market and expected to grow rapidly in the years ahead, according to a recent study by the Boston Consulting Group.

Market players such as Shenzhen-based Mindray and United Imaging are already the top three worldwide and many more hidden champions have taken global positions in the past decade.

In the digital healthcare space, Ping An Good Doctor – part of the world’s second largest insurer Ping An’s ecosystem - has made big strides in the last five years and is often considered a leading example for both global insurance and healthcare companies alike.

In short, the current boost in Med Tech is not driven by short-lived unicorns or opportunistic entrepreneurs.

China is on sick leave but never complacent. It would be unwise to underestimate the entrepreneurial spirit, pragmatism and problem-solving attitude of Chinese companies. China will come out of the crisis differently but not less strong.

You can copy the link to share to others: https://www.yitutech.com/node/851

Related articles

-

China should have role in setting global AI standards

-

YITU Healthcare Wowed US Audience by Demonstrating its Advanced “AI” Healthcare Research Platform with an Ambitious Global Strategy

-

Realizing AI’s full potential will take time in China

-

Yitu unveils new AI cancer detection tool, hailing such products ‘great creations in human history’